[PDF] Accounting For Fixed Assets Ebook

Depreciation And Disposal Of Fixed Assets Play Accounting

Fixed asset - Wikipedia Fixed assets, also known as tangible assets or property, plant and equipment (PP&E), is a term used in accounting for assets and property that cannot easily be converted into cash.This can be compared with current assets such as cash or bank accounts, described as liquid assets.In most cases, only tangible assets are referred to as fixed. IAS 16 (International Accounting Standard) defines ... Accounting for Fixed Asset - Depreciation, Disposal ... Fixed assets are generally not considered to be a liquid form of assets unlike current assets. Examples of common types of fixed assets include buildings, land, furniture and fixtures, machines and vehicles. The term 'Fixed Asset' is generally used to describe tangible fixed assets. Fixed asset AccountingTools A fixed asset does not actually have to be "fixed," in that it cannot be moved. Many fixed assets are portable enough to be routinely shifted within a company's premises, or entirely off the premises. Thus, a laptop computer could be considered a fixed asset (as long as its cost exceeds the capitalization limit).

Reporting

Fixed Asset Register Template Accounting And Finance

Print Asset Information Reports

Fixed Asset Accounting Steven M Bragg 9781938910289

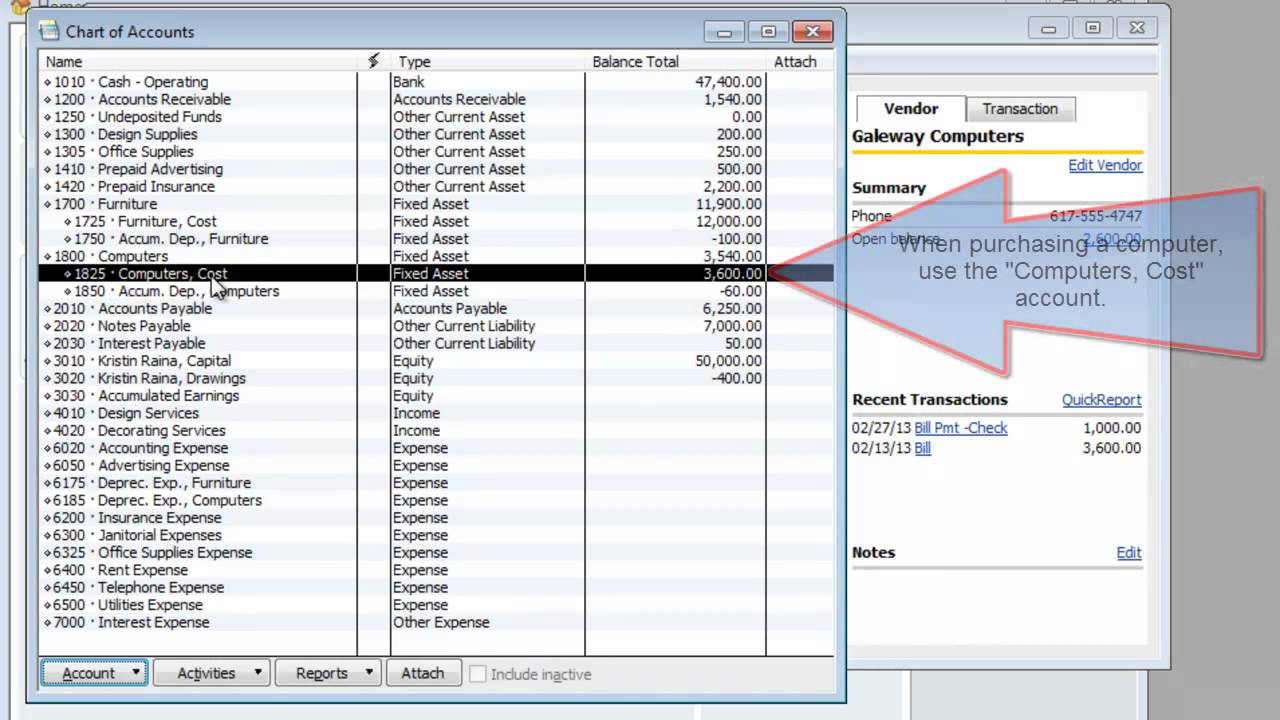

How Quickbooks Deals With Depreciation Lamoureph Blog

0 Response to "Accounting For Fixed Assets"

Post a Comment